Issues

A Microelectronic “Canary in a Coal Mine”

- Details

- Published: Tuesday, 07 September 2021 19:38

- Written by Honorable Alan R. Shaffer

- Hits: 6452

A Microelectronic “Canary in a Coal Mine”

A Call to a New Approach for National Security

Introduction

The United States no longer has the manufacturing capability or access to materials needed for continued economic growth and prosperity for our people. The United States is entering a period of increased national security risk due to lack of access to specific goods and products. One specific industrial sector—microelectronics—is emblematic of the issue. A similar argument could be posed concerning other sectors, like pharmaceuticals and certain raw minerals. But technologies that underpin the development of microelectronics, to include transistors, computers, digital programming, and others,1 were transformative technologies in which the United States dominated throughout the 20th century. The United States was able to both develop and manufacture products that sprang from them, and to dominate in microelectronics design and manufacture. As the global economy became more entrenched in the 21st century, manufacture and accessibility moved from the United States to other nations. This has led to a situation where both economic and national security is vulnerable due to supply chains that extend to global competitors. Using the semiconductor industry as the example of where supply chains have created vulnerabilities, we call for a new approach to national security by ensuring that critical industries can provide assured access.

Background

In the 2020 assessment of the state of the semiconductor industry, the Semiconductor Industry Association (SIA) paints a positive picture,2 touting that the United States had 47% of the 2019 global market. But the SIA assessment included signs of concern—the year-over-year global market in semiconductors declined from $468B in 2018 to $412B in 2019. Further, Asia accounts for roughly 80% of the physical semiconductor manufacturing. Then came the global COVID pandemic, which highlighted another impact—one that leaves the United States and US allies dependent upon potentially adversarial nations for critical goods. The pandemic highlighted the fragility of the international supply chain and this fragility’s impact on national and economic security. For example, given the importance of pharmaceuticals during the pandemic, it became apparent that the United States is dependent on China for over 70% of active pharmaceutical ingredients, according to a Forbes magazine article.3

In the same article, Kenneth Rapoza quotes members of the Alliance for Manufacturing Foresight (MForsight) stating: “China’s ‘Made in China 2025’ plan, which includes plans to expand in areas such as blockchain technology, artificial intelligence, robotics, semiconductor and chip making technology, along with biotech, should have the same effect on the US government as Russia sending a man into space [emphasis added].”4 COVID only shined a light on practices that were already well underway; China and other Asian countries use subsidies and other incentives to monopolize or dominate a market sector. In so doing, domestic manufacturers (in the United States and other Western nations) become uncompetitive; they transfer manufacturing to Asia or exit the industry all together—to the detriment of US national and economic security. This transfer of domestic manufacturing leaves the United States dependent and vulnerable. The situation is most extreme in the microelectronics industry.

Data is the New Oil—The Battle for Digital Supremacy

Microelectronics are the bedrock of the Information Age. Over the past several years, futurists have been using the phrase “data is the new oil” when talking about the foundation of the global economy.5 Just as oil drove the Industrial Era, data is driving the Information Era. The Information Era touches all walks of life from the consumer to the warfighter, and national and economic infrastructure. From a systems engineering viewpoint, one collects the raw information (sensors), stores the data (memory), transports the data (communications), and processes the data (as in artificial intelligence). Then, the result is displayed for action or insight. Each of these phases is wholly dependent on microelectronics. To be competitive in the information age, one must have access to a plethora of diverse microelectronics.6 Literally, the world has entered into the era of the “Battle for Digital Supremacy,” according to the title of an Economist article.7 The article begins by making the case that China’s information technology companies have evolved from manufacturing designs made by more technologically advanced nations (primarily the United States) to the present where Chinese companies have achieved technological parity or beyond with the West (United States and Europe).

If data is the new oil, digital supremacy is the foundation—the nation or coalition that can better navigate the world of data will have dramatic advantage in the consumer, military, national and economic security, and political spheres, which are the main components of national power.

Evolution of Microelectronics Manufacturing—United States in Decline

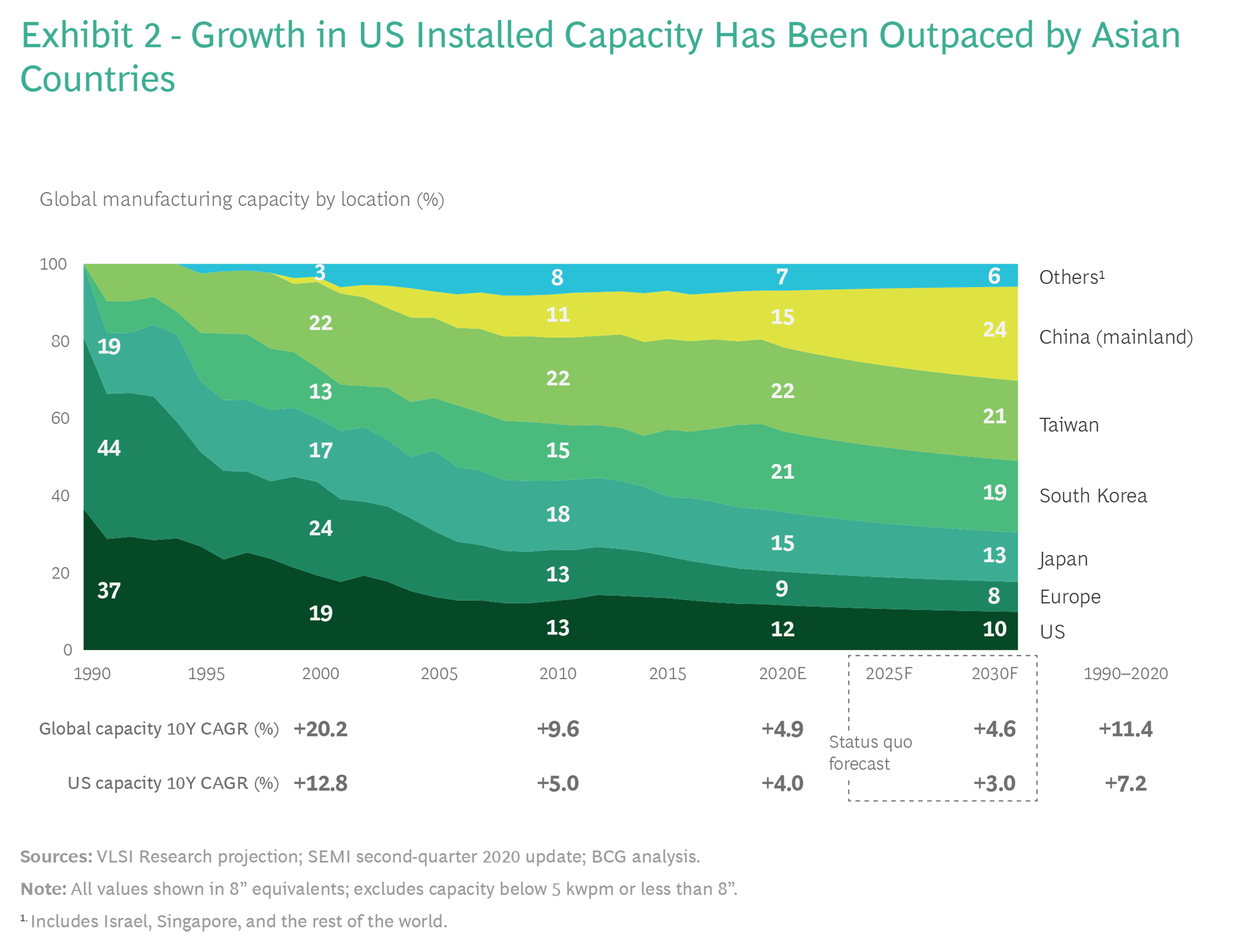

From the earliest days of the microelectronics industry, the United States has been the global semiconductor leader, consistently accounting for 45% to 50% of global sales (i.e., purchases of microelectronics); even today, the market share of sales is 47%. The spinoffs out of Fairchild Semiconductor in the 1960s spawned the world’s microelectronics industry, which created market-leading companies to include Intel, AMD, Sun, CISCO, NVIDIA, and others. But now, reportedly, the US share of the global semiconductor manufacturing capacity has fallen to 12% from 37% in 1990, and is expected to fall further as only 6% of the new global capacity is projected to be located in the United States.8 A February 2021 letter from 21 semiconductor industry CEOs to the President, citing these statistics, called for semiconductor manufacturing incentives and for research grants.9

These same data project that without such incentives, the combination of China, South Korea, Japan, and Taiwan will exceed 80% of the world manufacture market by 2030. Moreover, they project that the compound average growth rate for microelectronics manufacture in the United States is roughly half of the rest of the world combined—the US industrial manufacturing capacity will rapidly diminish to a small fraction of the rest of the world.

We, thus, present the following three findings, which leads to a serious conclusion for US national and economic security:

The US market demand for finished microelectronics products remains strong, at roughly half of the world market.

Over the last 30 years, the US manufacturing volume has declined to about 10% of global share, compared to 50% in Taiwan and China.

Manufacturing growth in Asia (and the rest of the world) is twice that of the United States (and Europe).

Therefore, an economic engine in microelectronics in the United States is built on a supply chain that may or may not be available to the United States, and the situation is becoming more extreme. As we will see, this dynamic may have affected the US economy in 2021.

To emphasize the finding that the United States is being phased out as a producer of microelectronics—detrimental to US access to these parts—please see Figure 1, which is based on projections from VLSI Research of global semiconductor manufacturing capacity.

There are several sectors of the domestic (US) microelectronics industry where there is even less capacity—notably memory, integrated circuits, and packaging and test facilities (which are called the Out-Sourced Test and Assembly, or OSAT, sector). The United States retains about 85% of the electronic design automation (EDA) tools sector, but only has 12% of the logic and 4% of the memory manufacturing markets.10 The OSAT sector is already controlled by China and Taiwan, with less than 5% of the market in the United States.11 The OSAT global market in 2018 was reportedly $27.7B, with all but one of the top ten OSAT companies (by volume) headquartered in Taiwan, China, and Singapore. Even when companies have offices or headquarters in the United States, manufacturing factories are mostly located overseas. Trade associations collect and sell detailed information concerning market sizes and the sales volume of OSAT firms worldwide,12 documenting the outsourcing of packaging and testing of semiconductors to a relatively few foreign facilities.

Said simply, the United States still has a dominant position in EDA tools for circuit design, but then sends the design to a non-US company to take the design to physical capability. What is less understood is that manufacturing processes and designs are just as critical, if not more, to producing highly complex circuits. The United States is no longer driving production and has become reliant on other nations.

Loss of Manufacture and Protection of Intellectual Property

Why does the fact that both manufacturing and package and test are conducted offshore present a challenge? Many would argue that this is just part of the global nature of the business. The issue is a loss of intellectual property (IP), which in turn, erodes the leading nation’s advantage.

Figure 1. Growth in the US Installed Capacity has been Outpaced by Asian Countries.

Figure 1. Growth in the US Installed Capacity has been Outpaced by Asian Countries.

Reproduced with permission from the Boston Consulting Group (BCG).13

We noted that the United States still is dominant in design of high-end microelectronic systems and applications. Unfortunately, the US-led design is outsourced for semiconductor manufacturing and for package and test. When designs are shared with manufacturers and packaging companies, they become much more vulnerable to IP theft. According to a 2019 article in Fortune Magazine, one in five US companies allege that they were a victim of IP theft within the past year, and a 2018 US Trade Representative report cited the estimated theft of US IP by China at $250-600B per year.14

In a 2017 article in The Economist magazine, the authors wrote: “think of Chinese competition as having three dimensions: illegal, intense, and unfair.”15 China and other countries have shown a propensity to engage in IP theft (the “illegal”), at enormous scale (the “intense”), leading to a situation whereby the theft of IP leads to a reduction in overhead cost that provides an advantage (the “unfair”). Where this becomes critical is in the outsourcing of the microelectronics manufacture and packaging and test, which permits China—or any other nation that would choose to engage in IP theft—to do so, and thus, reveal the design of the devices. The export of US microelectronic designs is a challenge to US national security. The current structure will lead to a loss of US advantage in short order.

While it appears that there may be some movement to diminish theft, it is clear from China’s 14th five-year plan that the People’s Republic is investing heavily in microelectronics, to include design.16 This five-year plan specifically discusses major Chinese investment in microelectronics research and development centers in other countries. We believe this indicates continued willingness to advance China’s design capabilities by any means possible.

Continuation of outsourcing of package and test to Asia makes the Chinese job to advance indigenous design easier. In other domains, China has clearly used predatory business practices to bridge the innovation gap,17 and the outsourcing of package and test makes this practice in the microelectronics domain much easier. In essence, the outsourcing of package and test risks relinquishing the US advantage in design. And when design goes offshore, so does manufacturing, thereby directly impacting US national security.

Furthermore, outsourcing of package and test questions the assurance and security of these parts. It is far too easy to substitute counterfeit parts. This endangers critical national security systems and consumer electronics, as well.

The Canary in the Coal Mine—Global Shortage of Specific Microelectronics

The COVID pandemic has reduced the worldwide demand for certain specialized chips (microcontrollers) needed for automobiles, while the “work at home nature” expanded the need for higher end communications and computer chips, as detailed in a Washington Post article.18 Production shifts were made by industrial partners in Asia, who did not take into account potential North American and European markets. As the world worked through the change in demand for specific chips, the microelectronics providers shifted focus from specialized automotive microcontrollers. This supply chain disruption is leading to a contraction in the number of new vehicles in 2021 by 1.5 to 5 million automobiles (from a base production in North America and Europe of 20 million units in 2019). The estimated cost to the global economy in 2021 is in excess of $60B.19 The Washington Post article cited Tom Caulfield, CEO of GlobalFoundaries as saying “Ford, Volkswagen, BMW, Daimler-Benz, Fiat, Chrysler, GM….every one of them became my new best friend.”20 Of note, this shortage has not been reported by Hyundai, Kia, and other Asian auto manufacturers.21 It is also interesting to note that 70% of the specialized microcontroller chips come from TSMC, in Taiwan. As the post-event analysis is done, it will be important to verify if the supply chain disruption occurred only in the West.

While this event may represent an unfortunate convergence of events, it should be seen as the “canary in the coal mine event” of the vulnerability of the West to a single-source, non-assured supply. This incident may well be the early signal or wake up call to a more serious problem for the United States.

Lack of domestic microelectronics production is a problem in both national and economic security, for both government and commercial sectors. As the United States exits the manufacturing sector, it will not return soon, as a new microelectronics fabrication facility costs anywhere from $4B to $20B for a state-of-the-art facility (depending upon function). Further, it takes four or more years to begin production. For example, in 2020, TSMC proposed building a new $12B fabrication facility in Arizona.22 Because of the specialized nature of semiconductors, and the cost involved with changing process lines, any disruption to the supply chain could and will ripple through the industry.

Breadth of the Microelectronics Challenge—It is Not Just Package and Test

The 2021 shortage of microcontroller chips is currently the most visible manifestation of security challenges for the United States in the microelectronics world. However, this supply chain disruption did not occur as a result of outsourced package and test, but rather due to specialized logic chips largely manufactured by TSMC. We noted earlier that over 95% of package and test capacity resides in Asia. We also know that roughly 80% of all memory devices come from foundries in Korea, Japan, and Singapore.23 In fact, the current automotive shortfall is in a sector where US manufacture capacity is actually better relative to memory and package and test. Therefore, we could expect similar or worse outcomes if we lost assured access to other microelectronics components where the United States no longer has a substantial market share, such as memory.

National Security Challenges Due to Economic Actions

So, what is the “concern”? What if a country decides to use the relative imbalance in production capacity with the United States as a political or economic lever?

This has been done before; and the analogy is ironic. The underlying foundation of the Industrial Era was oil. In 1973, the Organization of the Petroleum Exporting Countries (OPEC) ministers decided to restrict the production and distribution of oil to the West. At the time, the United States did not produce as much oil as it consumed. In 1973, the United States consumed 17.3M barrels per day (bpd), but only produced 11.4M bpd, so the imports of 6.26M bpd accounted for 36% of the US consumption.24 When coupled with other effects, like the decoupling of oil and gold (the end of the Bretton Woods agreement) and the US support for Israel in the Arab-Israeli war, the OPEC states restricted exports to the United States and other net importing nations. The result of the oil crisis was a four-fold increase in the cost of oil and the recession of 1973-1975. Coming out of this shock was hard; the US economy suffered from “stagflation” and a weakened economy.

While this example is a simplification, during the 1973 oil crisis, a small group of nations successfully controlled access to the underlying economic foundation. This resulted in an overamplified response in the West (to include North America). The same political or economic levers could be used on the United States or its allies with the microelectronics industry if the United States and US allies don’t revitalize the ability to meet manufactured demand. Actually, the impact could be much worse than during the 1973 oil crisis. OPEC is comprised of 13 member nations that control 44% of the global oil production and about 80% of the known reserves; in the 1970s, the United States depended on imports for only 36% of their energy needs. A microelectronics analogue to OPEC comprised of China, Taiwan, and South Korea would account for much more that 44% of the global microelectronics production, and the United States is importing as much as 80% of the microelectronics for US domestic use. The current demographic shift in microelectronic manufacture capability leaves the United States extremely vulnerable economically.

Simply stated, US and Western manufacture capacity currently does not meet the demand for microelectronics. If a country needs something that they do not produce, there is an inherent vulnerability. The United States is vulnerable. In microelectronics, this vulnerability is getting more acute, especially for national security. Further, the future economic structure of the United States is dependent on a supply of microelectronics outside of US control, which further jeopardizes future access to state-of-the-art technological capabilities. As seen with the “canary in the coal mine” example of microelectronics and the automobile industry, modern systems rely on access to the supply components not made domestically.

Congress has taken note of this problem. A February 2021 report “Beat China: Targeted Decoupling and the Economic Long War” released by Senator Tom Cotton (R-AR), points out that subsidy (government incentives) provided to the microelectronics industry by the US and Western European nations is roughly one-half to one-third that of South Korea, Taiwan, Singapore and China.25 Senator Schumer (D-NY) has called on fellow lawmakers to craft a package of measures that “target investment in US manufacturing, science and technology, supply chains and semiconductors…to counter China’s rise…to strengthen the US tech sector, and [to] counter unfair practices.”26 Senator Mark Warner (D-VA) is the lead co-sponsor of the Democracy Technology Leadership Act, which states “The People’s Republic of China is pursuing a set of policies to achieve dominance in key technologies…” and calls on an international partnership to counter China’s practices.27 In an interview, Senator Warner stated, “This is the defining economic issue of our time, there needs to be a sense of urgency… .”28 On February 24, 2021, an Executive Order on “Securing America’s Critical Supply Chains” explicitly directed a 100-day review of vulnerabilities caused by supply chain weakness in four specific industries: 1) active pharmaceutical ingredients; 2) critical minerals; 3) large capacity batteries; and 4) semiconductors and advanced packaging.

The challenge to the United States is becoming clearer with every passing day. From the initial shift of manufacture to Asia through the current “canary in the coal mine” event, the challenge is seen as largely apolitical—continuation of American economic, political, and national security strength has a foundation in microelectronics—and needs to be addressed today.

A Path Forward?

We have seen that there are national and economic security vulnerabilities with respect to microelectronics. The current economic playing field is not level—other countries, primarily in Asia, heavily incentivize their industries, and force in-country manufacturing as a means of market addressability leading to an unequal market balance.29 Without addressing the economic competitiveness of the US microelectronics industry, a sustainable business model will be challenging. It is, nonetheless, achievable.

This problem cannot be solved by either government or industry alone. The solution must resolve the cost differential between Asian firms and US-based companies. Discussions with US-based microelectronics industry executives indicate they can be competitive if the underlying cost structure is within 10% equivalency as opposed to the current 20-30% difference.30 This paper will not explore solutions deeply but will suggest some ideas that will need further elaboration.

The key point is that the scale and complexity of the problem requires new vectors of attack, and likely a public-private partnership for economic incentives coupled with a regulatory approach that restricts application of microelectronics from certain non-allied sources. Standard government approaches have not worked in the past; new and more innovative approaches are likely required.

Policy Options

A Berry Amendment-like Statute: USC 10 Section 2553a is the law known as the Berry Amendment—a statute that requires the Department of Defense to buy certain goods from domestic sources. Effectively, the Department of Defense must buy clothing, food, and some specialty metals from domestic sources. Development of a similar policy to direct microelectronics used for national security to be “Made in America” would provide incentives for domestic industry. Note that this restriction would not be limited to the Department of Defense (DoD), but rather, would cover all national security systems. In the past, when people thought about directing vendors to use pedigree microelectronics for national security systems, the proposers typically limited themselves to defense systems. Defense systems comprise about 2% of the total domestic market, and thus don’t drive production. In the information world, national security and economic imperatives includes the military and sectors critical national infrastructure, such as electric grids, sensitive verticals (banking, medical, etc.), transportation, and the national communications grid. Including all of these sectors grows the demand to nearly 25% of the United States market for microelectronics and is large enough to make a difference, affording a sizable and sustainable business model.

Enhanced Import Tariffs on Subsidized Goods: As discussed, most Asian nations subsidize their industry to enhance the Asian vendor competitive posture. While not illegal, it is not a practice available to domestic providers, nor is it “fair.” Increasing tariffs on imported chips could level the playing field. There are potential hazards to overall US competitiveness, but these risks are costs for security. While this does not, in and of itself, solve the problem of assured and secure pedigree of parts, it would provide a more level playing field for domestic producers.

Financial Options

Direct Company Subsidy: This option would be a direct investment by the US government into vital companies that are the most difficult to replicate. This could be done by either a standard competitive “FAR” (Federal Acquisition Regulation)-based solicitation or via a grant through something like the Defense Production Act. The previously cited publication by the BCG and the SIA predicts that the US market share will decline to 10% by 2030, despite building 9 new fabs.31 A $20B investment would increase the fabs and market to 14 and 12%, while a $50B investment would result in 19 new fabs and 14% of the global market. More importantly, the investment could enhance the United States as a state-of-the-art provider. Unfortunately, the model presented here has been tried before, and would likely require continued investment because it does not solve the issue of volume and continued viability of the partner who receives the grant. In the past, the DoD was never able to increase purchase volumes to make the investment sustaining. Whatever is done, there will need to be both financial and policy incentives.

A Mix of Investment and Loans: Suppose that, instead of a direct procurement, the government entered as a partner with industry. This is a more radical thought, because it uses government capital executed through an industrial company. As a partner, the US government may invest using a combination of direct investment and government-backed loans, such as are available from the Export-Import Bank (EXIM) or some other entity. In addition, the government can include procurements of capital equipment which can be “loaned” to industry and written off. There are also options with long-term commitments and regulatory support. Several ongoing studies are in the process of evaluating additional financial models that focus on potential solutions to either the Administration’s Build Back Better Plan or the Congressional CHIPS for America Act32 to enhance large-scale domestic production, with the idea of incentivizing private capital to co-invest.

Summary

As the world has moved into the era of data and information technology, data has become the new oil. Data systems and data processing are the key drivers of economic growth and national security and rely heavily on modern microelectronics. Without a secure and stable microelectronics supply, both economic stability and national security are vulnerable.

Currently, sources of microelectronics and their manufacture are concentrated in Asia, and in particular in China, which has caused the United States and many allied nations to become reliant on limited or non-reliable sources. This dependence has been increasing.

The causes of the concentration are myriad, but we have argued that deliberate unfair policies underlie the resultant dependence on China and certain Asian countries. These causes include the use of intelligence services to access Western IP at a massive scale, and heavy government subsidies to support industries in the microelectronics sector. China, in particular, continues to exercise predatory business practices that put the US posture in microelectronics at risk.

The vulnerabilities include the potential loss of access, at any time, whether deliberate or as a consequence of geopolitical events, which can harm economic interests or damage national security. As dependence increases, the United States becomes ever more vulnerable politically, economically, and militarily. This is a serious national security issue.

Solution to the challenge will not be found in either classic economic or government actions. Both policy and financial factors could mitigate the national security challenge, but addressing this will take a multi-prong approach involving government, industry, and academia, with regulations and incentives that over time will diminish US dependence. Congress and the Administration have taken note of the issue and have responded with multiple proposals attempting to strengthen the US microelectronics manufacturing capacity and promote innovation.

However, the nation must respond strategically. The United States did not get in this position quickly and getting out will take time, focused investment, and careful policy considerations. Microelectronics is but one sector—albeit critical—in which vulnerabilities must be reduced. A strategic plan to reassert US leadership in microelectronics, and success in this critical endeavor, would serve as a model across all sectors of critical importance to US economic and national security. It is now time to act on this strategic issue.

1. Durius Stusowski, “These Five Technologies Dramatically Changed the 20th Century,” March 14, 2017, https://historycollection.com/5-impactful-technologies-20th-century/3/.

2. “2020 State of the Semiconductor Industry Annual Report,” Semiconductor Industry Association, https://www.semiconductors.org/wp-content/uploads/2020/06/2020-SIA-State-of-the-Industry-Report.pdf.

3. Kenneth Rapoza, “Why is the United States so Ridiculously Dependent on China,” Forbes April 30, 2020, https://www.forbes.com/sites/kenrapoza/2020/04/30/why-is-the-us-is-so-ridiculously-dependent-on-china/?sh=e8c059e56b5c.

4. Kenneth Rapoza, “Why is the United States so Ridiculously Dependent,” referring to: Sridhar Kota and Thomas C. Mahoney, “Invent Here, Manufacture There,” Insight into Manufacturing Policy 20 (March) 2020, http://industrialpolicy.us/resources/Manufacturing/LossOfProductionCapabilities.pdf.

5. Mathematician Clive Humby is credited with coining the phrase; Others using the phrase include UnderArmor CEO Kevin Plank, and Director Emeritus of University of Southern California Innovation Lab Jonathon Taplin.

6. Throughout this paper, I am using the generic term “microelectronics” to include integrated circuits (logic devices, mixed signal chips), memory, and others.

7. “The Battle for Digital Supremacy,” The Economist Magazine March 17, 2018.

8. Antonio Varas, et al., “Government Incentives and US Competitiveness in Semiconductor Manufacturing”, Boston Consulting Group and the Semiconductor Industry Association, Sept 2020, https://www.bcg.com/en-us/publications/2020/incentives-and-competitiveness-in-semiconductor-manufacturing.

9. Semiconductor Industry Association (SIA), SIA Board of Directors, letter to the President dated Feb 11, 2021. https://www.semiconductors.org/wp-content/uploads/2021/02/SIA-Letter-to-Pres-Biden-re-CHIPS-Act-Funding.pdf.

10. Antonio Varas, et al., “Government Incentives and US Competitiveness.”

11. Antonio Varas, et al., “Government Incentives and US Competitiveness.”

12. Antonio Varas, et al., “Government Incentives and US Competitiveness.”

13. Market Research Reports, “Global 3D Semiconductor Packaging Market Growth (Status and Outlook) 2021-2026,” https://www.marketresearchreports.com/lpi/global-3d-semiconductor-packaging-market-growth-status-and-outlook-2021-2026.

14. Eric Sherman, “One in Five US Companies Say China Has Stolen Their Intellectual Property,” Fortune March 1, 2019.

15. “How China is Battling Ever More Intensely in Global Markets,” The Economist Sept 23, 2017.

16. Congressional Research Service summary, “China’s 14th Five Year Plan: A First Look, January 5, 2021.

17. Yukon Huang and Jeffery Smith, “China’s Record on Intellectual Property Rights is Getting Better and Better,” Foreign Policy Oct 16, 2019.

18. Jeanne Whalen, et al., “No Quick Fix for Chip Shortage, Hobbling Factories,” Washington Post March 2, 2021: A1.

19. Michael Wayland, How Covid led to a $60 Billion Global Chip Shortage for Automakers, CNBC Feb 11, 2021, https://www.cnbc.com/2021/02/11/how-covid-led-to-a-60-billion-global-chip-shortage-for-automakers.html.

20. Jeanne Whalen, et al., “No Quick Fix.”

21. Joyce Lee, “Analysis: Hyundai Bought Chips When Rivals Didn’t, Its Assembly Lines are Still Rolling,” Reuters Feb 26, 2021, https://www.reuters.com/article/us-autos-semiconductors-hyundai-motor-an/analysis-hyundai-bought-chips-when-rivals-didnt-its-assembly-lines-are-still-rolling-idUSKBN2AQ0EF.

22. Sharisse Pham, “Taiwan Chip Maker TSMC’s $12 Billion Arizona Factory Could Give the US an Edge in Manufacturing, CNN Business May 15, 2020, https://www.cnn.com/2020/05/15/tech/tsmc-arizona-chip-factory-intl-hnk/index.html.

23. 2020 State of the US Semiconductor Industry from the Semiconductor Industry Association, https://www.semiconductors.org/wp-content/uploads/2020/06/2020-SIA-State-of-the-Industry-Report.pdf.

24. US Energy Information Agency (www.eia.gov).

25. Antonio Varas, et al., “Government Incentives and US Competitiveness.”

26. Richard Cowan and Alexandra Alpers, “Top US Senate Democrat directs lawmakers to craft bill to counter China,” Reuters, February 21, 2021, https://www.reuters.com/article/us-usa-china-democrats/top-u-s-senate-democrat-directs-lawmakers-to-craft-bill-to-counter-china-idUSKBN2AN2HJ.

27. Mark Warner, “Bipartisan National Security Leaders Agree: ‘The Democracy Technology Partnership Act Outlines an Important Vision and Strategic Plan for the U.S.’,” Mar 30 2021, https://www.warner.senate.gov/public/index.cfm/pressreleases?ID=AE800673-B962-4F48-AC10-F203760D2F74.

28. Mark Scott “Senior US Senator Calls for Western Tech Alliance Against China,” Politico, 12 March 2021, https://www.politico.eu/article/mark-warner-digital-bridge-tech-china/.

29. There is also a fairly substantial body of evidence that China deploys their nation-state intelligence services against companies competitive with their state-owned enterprises.

30. Private discussions between the author and select microelectronics CEOs/COO. Also, the 30% difference is explained in Antonio Varas, et al., “Government Incentives and US Competitiveness,” Exhibit 8.

31. Antonio Varas, et al., “Government Incentives and US Competitiveness.”

32. H.R.7178 - 116th Congress (2019-2020): CHIPS for America Act | Congress.gov | Library of Congress, https://www.congress.gov/bill/116th-congress/house-bill/7178.