Minerals and Civilization

Minerals and Civilization

Earth’s natural mineral resources provide vital ingredients to the technologies that are fundamental to modern society. Epochs of civilization have long been defined by the metallurgical technologies of the time—from copper to bronze, and later iron, and most recently, steel. Over millennia, humans have extracted new and varied materials from ores, combined them into alloys, and used these naturally derived products to make the technologies of their age. Many different minerals are key constituents in today’s consumer electronics, green technologies, military hardware, medical tools and devices, automobiles, satellites, and most every product of modern civilization.

Minerals have various properties that make them particularly useful for specific applications. Iron is much stronger than bronze, which in turn is stronger than copper. Chromium helps make steel non-corrosive. Lithium is useful for making rechargeable batteries. Single crystal silicon is the basis for most semiconductors. Titanium and titanium-aluminum alloys are used in jet engine fan blades due to their strength and light weight. Zirconium is used for the cladding of nuclear power plant fuel rods, sometimes alloyed with niobium. Xenon is used as a propellant for ion thrusters on satellites. An alloy of iron, neodymium, and boron has high ferromagnetism and thus makes the strongest permanent magnets. Ongoing research by scientists continues to find new alloys and mineral combinations to improve material properties and uncover new utility.

With the ever-expanding list of minerals in new products, we see how essential they are for everyday life. Consumer products, defense applications, power generation, transportation, and even food products make extensive use of minerals. Future developments in clean energy, smart cities, mobile communications, and other sectors will result in even higher demand for minerals. It is therefore critical that the United States ensure its access to these vital resources, for today and tomorrow.

What is Critical about Critical Minerals?

With the current US focus on supply chains, it is reasonable to ask whether the supply of minerals will continue to meet demand, and whether shortages may occur should suppliers become limited.

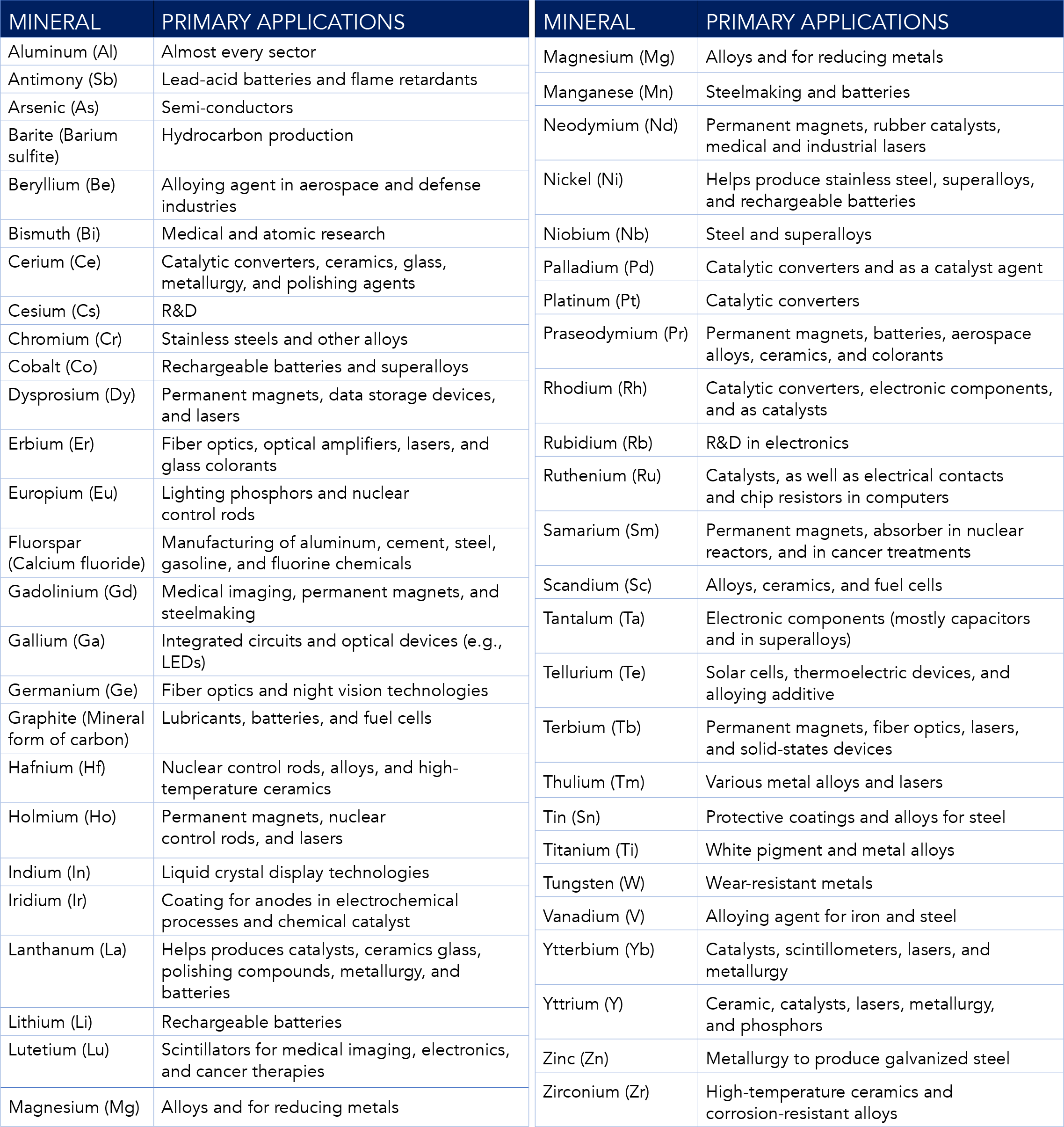

In the United States, certain materials are designated as “critical minerals.” US Executive Order 13817, from 2017, defines critical minerals as non-fuel minerals resources that are of vital importance, essential to the manufacturing of products, and for which the supply chain is vulnerable. The Energy Act of 2020 directs that a list of critical minerals be revised every three years. The US Geological Survey (USGS) publishes such a list, which in 2018 included 35 critical materials1. The updated 2022 list has 50 minerals2 (see list). Most minerals are simply listed by their principal metallic element, but some have been given common names referencing specific molecular materials, such as barite (barium sulfate), fluorspar (calcium fluoride), and graphite (a specific form of carbon). Criticality, and thus inclusion on the USGS listing, is a judgement call.

Stockpiling and Supply Chains

The US Department of Defense (DoD) stockpiles critical minerals for national security purposes under the National Defense Stockpile, and some minerals for clean energy technologies, per an agreement with the Department of Energy3. Stockpiling has a long history in the United States, from the Strategic and Critical Materials Stock Piling Act of 1939, to other programs in subsequent years such as the Strategic National Stockpile4 (mostly medical equipment), the Strategic Petroleum Reserve, and the National Defense Stockpile. The latter, maintained by the Defense Logistics Agency5, contains about a billion dollars worth of metals. Reliance on stockpiling is considered by many to be problematic6 as it requires a determination of what minerals (and materials and equipment) are critical, how much needs to be stored to provide for strategic contingencies, and the act of building a stockpile only further distorts an already constrained supply chain. Stockpiling generally focuses on defense needs rather than the needs of the civilian economy. Often, reliance on critical minerals is hidden because materials are incorporated in imported finished or semi-finished goods7.

Today, China has a stranglehold on many critical minerals supply lines. In 2010, China curtailed the shipment of rare earth elements (REEs) to Japan because of a maritime dispute8. In 2020, China similarly threatened to cut off REE supply to three US-based defense manufacturers9, endangering F-35 production, in response to a US defense deal with Taiwan.

Table 1. Critical Minerals with their Primary Applications*

* Adapted from the US Geological Survey 2022 List of Critical Minerals

“U.S. Geological Survey Releases 2022 List of Critical Minerals,” U.S. Geological Survey, February 22, 2022.

The Russian-Ukraine conflict in 2022 has put another spotlight how foreign policy decisions can affect global supply chains. In addition to its reserves of oil and gas, Russia is a major supplier of certain metals. As one example, the price of palladium used in automobile catalytic converters has shot up since the Russian invasion of Ukraine10.

Natural catastrophes, such as disease outbreaks or extreme weather events, can impact any point in the supply chain, causing reductions in available personnel or facilities.

Of the 50 designated critical materials from the USGS listing, the United States is 100% reliant on imports for fourteen of them, and more than 75% reliant on imports for another ten.

In February 2021, Executive Order 14017 launched a 100-day review and strategy development process to address vulnerabilities in the US supply chains that included critical minerals and materials as one of the focus areas11. In February 2022, the Administration announced a number of actions to secure supply chains for certain minerals12. In April 2022, the Defense Production Act (DPA) was invoked to boost critical mineral production in the United States.

The National Strategic and Critical Minerals Production Act, intended to change rules and regulations surrounding mining permitting in the United States, has been introduced in various forms several times in Congress since 2012, but has yet to pass. Hearings continue to be held on the Hill regarding critical minerals in an attempt to further secure supplies.

With growing demand and reliance on critical minerals (see box, “Anticipating Needs”), not every user will be guaranteed access. The anticipated increase in market demand for certain materials could lead to competition among end-product manufacturers.

Anticipating Needs

What are the likely critical minerals of the future? Where are the likely supply bottlenecks?

While the future is hard to predict, it is a safe bet that the future will involve a large demand for certain minerals. Overall demand for current critical minerals is increasing, with a predicted five-fold increase in use by 205013. Electric vehicles will require large supplies of lithium to be used for the production of batteries, and may require other critical minerals. Electric vehicles are estimated to use six times the amount of critical minerals relative to conventional cars14. Until alternatives can be found, the cobalt used in lithium-ion batteries could become especially critical. Rare earth elements (REEs), such as neodymium, are expected to be increasingly important for magnets used in motors and generators. Clean energy systems are said to require, in addition to lithium and REEs, nickel, manganese, and aluminum—all in large quantities15. A resurgence of nuclear power sources using new technology plants might require large resources of uranium and/or thorium, boron, zirconium, and other yet-to-be-determined materials. Aerospace applications are looking at new airframe structures and more efficient engine designs, as well as stronger and lighter landing gear and corrosion resistant components, all of which will involve minerals and new manufacturing techniques involving different materials.

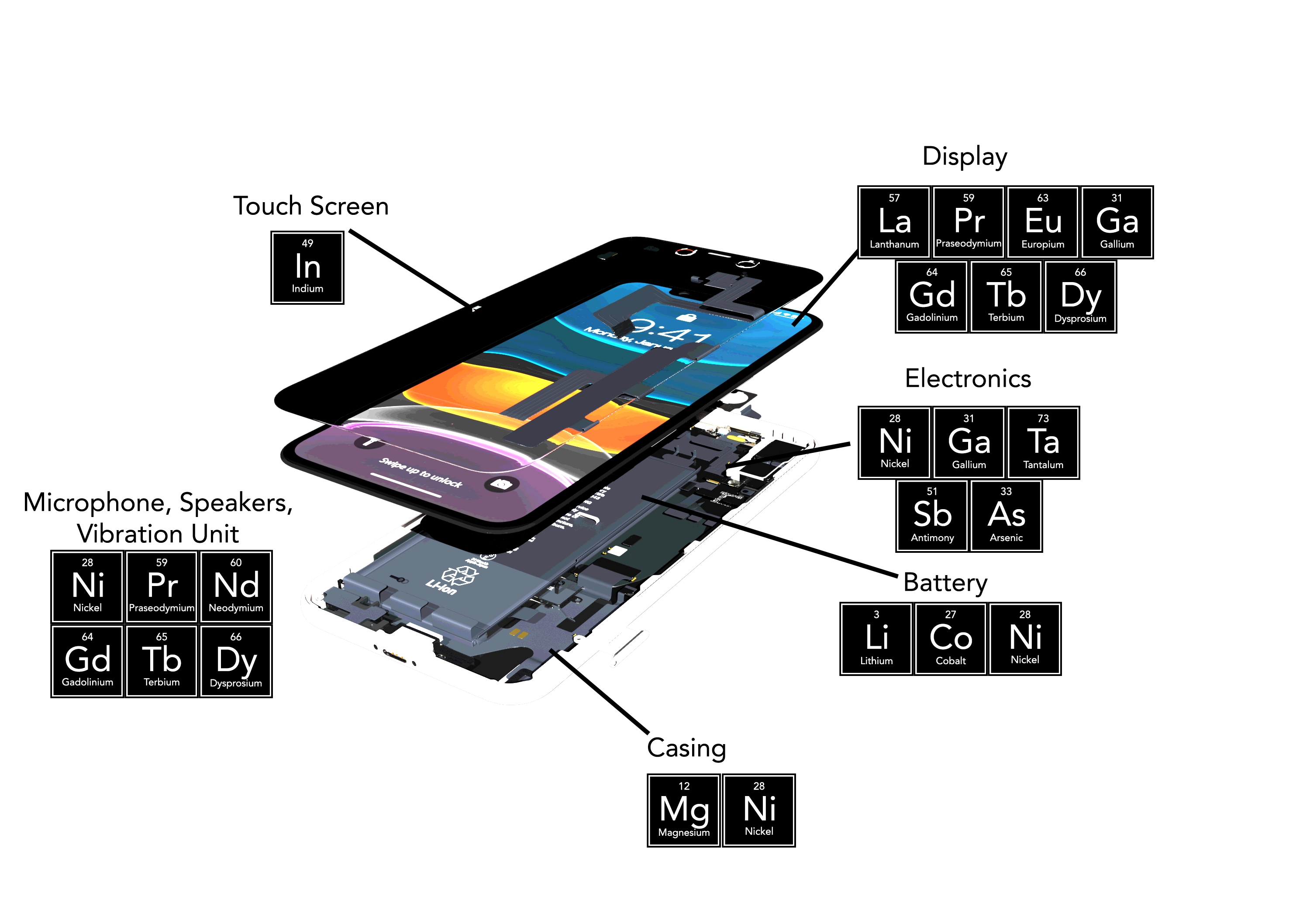

It is not just the quantity of minerals required that will determine which are critical. The diversity of materials in products is increasing: the average smartphone contains something like 75 different materials sourced from minerals (see figure).16,17 A supply chain issue in any one material might hamper production.

From Rock to Commodity

Critical minerals are generally distributed throughout the earth, embedded in rocks in the crust of the earth at varying concentrations. Certain rocks contain relatively high concentrations of particular minerals, and those ores tend to be located in small pockets in certain locations—i.e., potential mine sites.

Today, many minerals are exploited from just a few mines, and sometimes predominantly just one main mine, providing a source for the rest of the world. For example, South Africa and Zimbabwe produce 80% of the world’s platinum, Australia and Chile produce 75% of the world’s lithium, and 75% of cobalt is extracted in the Democratic Republic of Congo18.

Rare earth elements are not rare in overall terrestrial abundance19, but are found in low concentrations mixed in with other elements and minerals20. The rare earth metal neodymium (Nd), used for making strong permanent magnets and special lasers, is found in low concentrations in the ores monazite and bastnäsite. While these ores can be found in earth’s crust throughout the world21, more than half of the known minable concentrations are found in China and Vietnam22.

Separating elements and minerals from rocks often requires complex chemical processes, and results in waste materials that often contain toxic and/or radioactive byproducts23. Further, the separation and refining process is often energy, water, and other resource intensive. Refining is often done in distant locations from the mining operation. China currently performs roughly 90% of the refining and production of REEs into magnets.24,25 There are minerals mined in the United States that are exported to China for the processing and refining stages26. Similarly, more than half of all lithium extracted globally is currently refined in China27.

Refined minerals are then purchased and used by manufacturing firms to make products. Today, roughly 30% of the world’s manufacturing of products takes place in China28.

Prospects for Mineral Production in the United States

The United States is not without natural resource reserves of its own. For example, the company MP Materials hopes to secure sufficient REE magnets for US needs using domestic mining, processing, and manufacturing. Berkshire Hathaway Energy is building demonstration plants to explore the extraction of lithium from Imperial Valley29 in California and from the brine of geothermal power plants at the Salton Sea also in California30.

However, the mining permit process in the United States averages 7 to10 years. In contrast, countries like Australia and Canada have typical permitting processes of 2 years31. Mining and refining operations require a large operation and a trained workforce32, and it has been difficult for American companies to compete financially. The history of the Mountain Pass mining operation is illustrative of the problems facing the US mining industry (see box page 57). Similarly, the Albemarle lithium mine in North Carolina33 shut down in 2021 because the then-depressed global lithium prices could not balance the regulatory and operating costs. A US Administration “Interagency Working Group” is developing legislative and regulatory proposals to support “responsible mining” in the United States34.

Mountain Pass Mine, Molycorp, and MP Materials

In the mid-1900s, the United States dominated much of the global market for REEs and related materials. From the mid-1960 until the ‘80s, Molycorp’s Mountain Pass (MP) mine in California was considered the world’s top source of rare earth oxides35. But environmental and financial challenges at Mountain Pass led the mine to close in 2002. In 2012, Molycorp reopened MP, only for China’s increased production to greatly outpace demand, driving down prices, and causing Molycorp to file for bankruptcy in 2015. In 2017, MP Materials Corp purchased the mine. In 2020, Mountain Pass supplied almost 16% of the world’s REE production. In October 2020, Shenghe (a Chinese company) was the sole buyer of the mine’s rare earth concentrates, which it then sent on to China for processing36. The mine went public in 2021, and the Nuclear Regulatory Commission authorized the mining license to be transferred; Shenghe has about 8% ownership of MP Materials now37. The mine continues to face hurdles and investing complexities38. In February 2022, DoD announced it would be investing just over $100 million to enhance America’s rare earth supply chain resiliency, including $35 million to MP Materials to separate and process heavy REEs at the Mountain Pass facility in California. It was further announced the MP Materials would be building a magnet manufacturing plant involving $700 million in investments, with the intention of providing an end-to-end rare earth magnet production capability in the United States. Ground has broken on a manufacturing facility in Texas39.

Image:Bradley Van Gosen/U.S. Geological Survey

US Supplies of Minerals Going Forward

In 2019, the United States published a Federal strategy “to ensure secure and reliable supplies of critical minerals,40” which includes a call to “improve understanding of domestic critical mineral resources,” from ores as well as from recycling. (The US Government Accountability Office has recommended that the strategy be updated.41) The US Department of Energy has developed an R&D roadmap42 to diversify supplies, develop substitutes, and improve reuse and recycling, to include all aspects of the supply chain (mining, refining, manufacturing, and recycling). The US DoD was the lead for the critical minerals and materials report in the 100-day study responding to the executive order 14017 on America’s supply chains, promoting sustainable production and conservation of strategic and critical materials43, and recommending (among other actions) “expanding sustainable domestic production and processing,” which includes recycling and new mining methods. A DoD action plan and update was provided by DoD in February 202244. The way forward involves securing supplies of minerals and developing alternatives that use supplies that are more easily accessed, as detailed in the strategies and action plans developed by the various US agencies.

Securing Supplies

The national interest is for more stable supply chain of resources, mitigating the risk of supply chain disruptions. The US DoD has “mapped” the sources and supply chains for critical minerals and strategic and critical materials as well, and has identified “latent capacity” of the United States to produce materials if sufficient incentives were in place45. The implication is that through a network of agreements and policy measures, it should be possible for the United States to ensure sufficient supplies for decades to come.

Discerning multiple pathways can help provide greater stability and help contain costs. Proactively finding multiple supply pathways is often feasible. For example, uranium is produced and exported from Canada46 and lithium by Pilbara Minerals in Australia47. Japan has made headway in processing and refining REEs48, reducing its dependence on supplies from China compared to 2010, through investment and partnerships in other countries. Arsenic is imported to the United States from Morocco and Belgium in addition to China. There are proposals to create a “Five Eyes for critical minerals,49” or to establish a North American mining center based on mineral reserves50.

It thus may behoove the US government to exercise levers of influence though loans, subsidies, regulations, market guarantees, and tariffs to stimulate domestic production of certain critical minerals to ensure supply stability, as well as fostering agreements with allies and trustworthy sources for access to minerals. The strategy requires, however, that accurate predictions be made by government forecasters as to the likely demand and criticality of specific materials. This is a complex endeavor that is generally handled by companies for the commercial marketplace.

Invest in Research and Development for Alternatives

A complementary approach to securing supplies of critical minerals is to pursue research and development (R&D) that might uncover comparable or improved capabilities separate from today’s processes or materials. Research might lead to better and more efficient end-products that make use of components with more accessible supplies. Alternative materials as well as advances in mining, processing, and recycling can relieve pressure on the current critical minerals supply chains.

New composite materials, such as carbon fiber, are finding utility in replacing metals for structural elements of products. Research in the field of materials science has explored substitute materials for materials for neodymium51 in wind turbines and magnets52. Advanced Research Projects Agency–Energy (ARPA-E) sponsored a “Rare Earth Alternatives in Critical Materials53” (REACT) project to study replacements for REEs54. Other research searches for practical superconducting materials. Research involves risk, but payoffs can be large.

Research might also lead to improved extraction and refinement methods to obtain minerals. The development of new extractive techniques could shift the economic balance of mineral deposits previously deemed incapable of delivering a positive return. Offshore deep-sea mining might deliver new supplies of minerals, if additional policy issues can be overcome55. Some believe asteroid mining may also provide accessible reserves of critical minerals if costs can be brought low enough.

Research and development, particularly in the materials sciences area, can provide benefits for the general good. Historically, the most innovative and beneficial research begins with US government direction.

Summary

Critical minerals are essential for the composition of many consumer devices and defense applications. Demand is expected to explode in the upcoming years, but it is unclear if supplies will be available to all. The US defense and commercial sectors will be negatively impacted if access to needed materials becomes limited. The “critical mineral” designation already signals that there may be a supply chain vulnerability of these materials due to reliance on imports.

To mitigate risk, the United States is attempting to stabilize supply chains, encompassing mining, processing, refining, and manufacturing. Between invigorating domestic production and secure supply chains, and developing new materials for alternatives, the United States should be able to satisfy needs for minerals and other materials far into the future.

Endnotes

1. “Final List of Critical Minerals 2018,” A Notice by the Department of the Interior, 83 Federal Register 23295 (May 18, 2018).

2. Jason Burton. “U.S. Geological Survey Releases 2022 List of Critical Minerals,” United States Geological Survey, February 22, 2022.

3. “US Departments of Energy, State and Defense to Launch Effort to Enhance National Defense Stockpile with Critical Minerals for Clean Energy Technologies,” U.S. Department of Energy, February 25, 2022.

4. Anshu Siripurapu. “The State of U.S. Strategic Stockpiles,” Council on Foreign Relations, 20 April 2022.

5. “About Strategic Materials,” Defense Logistics Agency, July 11, 2022.

6. Dolf Gielen, et al. “Critical Minerals and Materials: Supply Bottlenecks and Risks Need International Cooperation,” Energy Post February 25, 2022.

7. Nedal T. Nassar, Elisa Alonso, and Jamie L. Brainard. “Investigation of U.S. Foreign Reliance on Critical Minerals—U.S. Geological Survey Technical Input Document in Response to Executive Order No. 13953 Signed September 30, 2020,” U.S. Department of the Interior and U.S. Geological Survey, Open-File Report 2020–1127, December 7, 2020.

8. “China Denies Banning Rare Earths Exports to Japan,” Reuters September 23, 2010, .

9. Sun Yu. “China Targets Rare Earth Export Curbs to Hobble US Defense Industry,” Financial Times February 16, 2021.

10. Jim Kilpatrick. “Supply Chain Implications of the Russia-Ukraine Conflict,” Deloitte Insights, March 25, 2022.

11. “Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth,” 100-Day Reviews under Executive Order 14017, The White House, June 2021.

12. “FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals,” The White House, February 22, 2022.

13. “Climate-Smart Mining: Minerals for Climate Action,” The World Bank, July 11, 2022.

14. Nick Ferris. “The Role Critical Minerals Will Play as the World Transitions to Net Zero,” Mining Technology, 11 August 2021.

15. Nick Ferris. “The Role Critical Minerals Will Play.”

16. Poul Emsbo, et al. “Geological Surveys Unite to Improve Critical Mineral Security,” EOS (102) February 5, 2021.

17. Bruno Venditti. “Visualizing the Critical Metals in a Smartphone,” Visual Capitalist, August 24, 2021.

18. Vikas Agrawal and Shikha Sharma. “Critical Minerals: Current Challenges and Future Strategies,” International Journal of Environmental Sciences & Natural Resources 27(3) March 2021: 556215.

19. For example, cerium is ranked 25th in overall terrestrial abundance, making it more abundant than copper or lead.

20. K. Lyon, et al. “Enhanced Separation of Rare Earth Elements,” 2016 International Mineral Processing Congress, Idaho National Laboratory, September 2016.

21. Vladimir Alekseenko and Alexey Alekseenko. “The Abundances of Chemical Elements in Urban Soils.” Journal of Geochemical Exploration 147 (2014): 245–249.

22. Nicholas LePan. “Rare Earth Elements: Where in the World Are They?” Visual Capitalist November 23, 2021.

23. Cameron Tarry and Faith Martinez-Smith. “Supply Chain for Lithium and Critical Minerals Is … Critical,” ClearPath, June 11, 2020,

24. “FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals.” The White House.

25. “Rare Earth Permanent Magnets: Supply Chain Deep Dive Assessment,” U.S. Department of Energy Response to Executive Order 14017, February 24, 2022.

26. Jeffery Green. “America’s Critical Minerals Problem Has Gone from Bad to Worse,” Defense News May 2, 2018.

27. “The Role of Critical Minerals in Clean Energy Transitions,” International Energy Agency, World Energy Outlook Special Report, May 2021.

28. “China Accounts for 30% of Global Manufacturing Output: Official,” China Daily June 14, 2022.

29. “Just the Facts: BHE Renewables—Lithium,” BHE Renewables, April 2022.

30. Beth McKenna. “A Lithium Rush Is on at California’s Salton Sea: Who Are the Players?” The Motley Fool, June 8, 2022.

31. Jeffery Green. “America’s Critical Minerals Problem.”

32. Emma Penrod. “As US Aims to Boost Clean Energy Supply Chain, Critical Minerals Gap Largely Human-caused, Analysts Say,” Utility Drive, June 17, 2021.

33. Amena Saiyid. “US Mineral Mining Badly Lags Biden’s Clean Energy Goals,” IHS Markit, February 8, 2022.

34. “FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals,” The White House.

35. Marc Humphries. “Critical Minerals and U.S. Public Policy,” Congressional Research Service, June 28, 2019.

36. Mary Hui. “A Chinese Rare Earths Giant is Building International Alliances Worldwide,” Quartz, December 28, 2021.

37. Edward Lawrence and Tyler Kendall. “Biden Can’t Keep China Out of “Made in America.’” Fox Business, April 15, 2022.

38. Frank Umbach. “Rare Earth Minerals Return to the U.S. Security Agenda,” Geopolitical Intelligence Services, August 1, 2019.

39. Bob Hanes. “Rare Earths Giant MP Materials Invests Heavily to Rebuild a U.S. Magnetics Supply Chain,” Investor Intel, June 14, 2022.

40. U.S. Department of Commerce, “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals,” June 4, 2019.

42. US Department of Energy, Critical Minerals and Materials, US Department of Energy’s Strategy to Support Domestic Critical Mineral and Material Supply Chains (FY 2021- FY 2031).

43. “Building Resilient Supply Chains,” 100-Day Reviews.

44. US Department of Defense, Securing Defense-Critical Supply Chains, An Action Plan Developed in Response to President Biden’s Executive Order 14017, February 2022.

45. “Building Resilient Supply Chains,” The White House.

46. “Uranium in Canada: Everything You Need to Know,” Canada Action, April 2, 2021.

47. Rachel Pupazzoni. “Australia’s Lithium Miners Powering the Global Electric Vehicle Charge,” ABC News, July 29, 2021.

48. “The Role of Critical Minerals in Clean Energy Transitions,” International Energy Agency, World Energy Outlook Special Report, April 27, 2022.

49. Dwayne Ryan Menezes. “Launch of Report: The Case for a Five Eyes Critical Minerals Alliance Focusing on Greenland,” The Polar Connection, March 4, 2021.

50. Mary Ng. “Canada’s Vision for a Resilient North American Trade Relationship,” The Brookings Institution, February 28, 2022.

51. Neodymium Magnets Are the Strongest Type of Permanent Magnet. See: “FAQ,” Amazing Magnets, July 11, 2022.

52. There are, however, currently no viable substitutes for REEs in magnets that offer the same performance. See: “New Alternatives May Ease Demand for Scarce Rare-earth Permanent Magnets,” ScienceDaily April 2, 2019.

53. “Rare Earth Alternatives in Critical Technologies,” ARPA-E, July 11, 2022.

54. “New Tricks for Finding Better Superconductive Materials,” Phys.com, October 25, 2021.

55. Aryn Baker. “A Climate Solution Lies Deep Under the Ocean—But Accessing It Could Have Huge Environmental Costs,” Time September 10, 2021.